News | Industrial Combustion Equipment

All the latest News on our company

Green Hydrogen Projects in Latin America and the Caribbean

Posted on: 24 / 07 / 2023 | 0 Comentarios | Tags: Green hydrogen projects in Latin America and the Caribbean, Proyectos de hidrógeno verde en América Latina y el Caribe

Currently, there are more than 140 green hydrogen projects in Latin America and the Caribbean in different stages of development, mainly in the pre-feasibility and feasibility phases. Although current hydrogen production in this region is mainly obtained from fossil fuels, some countries have already gained experience with water electrolysis, according to the report “Renewable Hydrogen in Latin America & The Caribbean: Opportunities, Challenges and Pathways” .

The study, developed by the LAC Green Hydrogen Action alliance, which brings together hydrogen associations from Chile, Colombia, Costa Rica, Mexico and Peru, has been responsible for recently identifying and censusing this total of 140 green hydrogen projects in America Latin and the Caribbean.

The pioneer country in this field is Peru, according to data from the International Energy Agency, having been the first country to operate the oldest electrolyzer in the world for the production of hydrogen using electricity from the grid, a high-speed alkaline electrolyzer. scale of 25 MW, for the production of ammonium nitrate since 1965. Although it was mainly supplied with electricity from the grid, in 2022 it signed a PPA for renewable energy certified according to the REC International Standard.

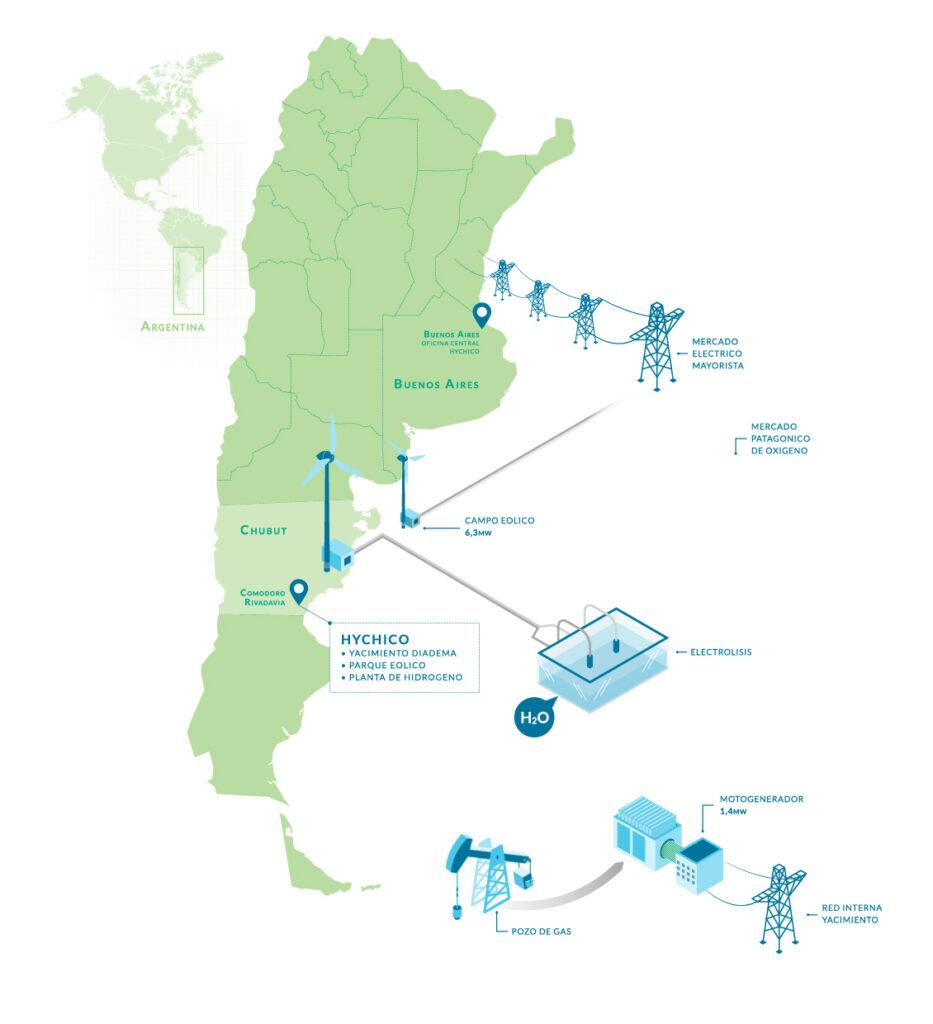

For its part, the first Latin American pilot project for renewable hydrogen was launched by Hychico in 2008 in Argentina. It produces 52 t RH2/year from wind energy using two alkaline electrolysers with a collective capacity of 9.55 MW.

Additionally, small-scale electrolyzers have been operated in the region, such as Chile’s Cerro Pabellón microgrid project, Costa Rica’s Ad Astra Servicios Energético y Ambientales pilot project, and Colombia’s first electrolyzer, a pilot project operated by Ecopetrol.

Green Hydrogen Projects in Latin America and the Caribbean

Chile has the largest number of announced hydrogen projects. In October 2021, the Ministry of Energy noted that there were more than 60 renewable hydrogen projects in different stages of development, although about 50 had been publicly announced. 25% of them are expected to come online before 2030. Most are private projects and few have some state support.

Thus, in 2021, the Chilean Economic Development Agency, CORFO, announced 50 MUSD in financing for six projects. Along with this initiative, the Government presented a 1 BUSD financing program to catalyze private investment in production and demand projects, mitigate risks and reduce costs. This fund includes loans and contributions from the Inter-American Development Bank (400 MUSD), the World Bank (150 MUSD), the German Development Bank (100 MUSD) and the European Investment Bank (109.67 MUSD).

In turn, the European Union contributes 16.45 million dollars through the investment fund for Latin America and 830,000 dollars for technical assistance. Finally, CORFO complements it with 250 MUSD. The facility will be managed by CORFO and will begin operating in the second half of 2024, with the aim of leveraging an investment of 12.5 BUSD.

Brazil, second position in projects

Brazil has the second largest number of hydrogen projects of the Latin American and Caribbean countries analyzed: 42 projects were identified, most of them in development. More information in the Report by E&M Combustión: “Green Hydrogen Projects in Latin America”.

Next, Colombia continues with 27 projects, followed by Argentina with 11, Mexico with 9, Costa Rica with 7, Uruguay with 6 and Peru with 5.

Regarding hydrogen projects already operational, Chile has five. Among these is Cerro Pabellón, a microgrid project by Enel Green Power that produces 10 t RH2/year using a 50 kW PEM electrolyzer to meet the needs of a community of technicians working in a geothermal plant. Other examples are Haru Oni, HIF’s operational pilot project using 1.25 MW electrolysis power, CICITEM’s mobile hydrogen plant, using 0.02 MW electrolysis power to test production efficiency in different conditions, the H2GN project for mixing purposes, and the Anglo American pilot project that produces 2 kg of renewable hydrogen per day and powers forklifts, using the first hydrogen station in Chile.

Colombia has five operational renewable hydrogen pilot projects, among which is an initiative to replace gray hydrogen with renewable hydrogen at Ecopetrol‘s Cartagena refinery, using a 50 kW PEM electrolyzer to produce 20 kg of hydrogen per day. The Promigas pilot project produces 1.5 t RH2/year using a 53.2 kW PEM electrolyzer for injection into the natural gas network. Colombia also has two 60 MW projects in the refineries being developed by Ecopetrol, Total Eren and EDF.

Costa Rica stands out for its transportation projects in operation, such as the Ad Astra pilot project, which has been in operation since 2013. It currently produces 2.5 kg of renewable hydrogen per day (0.8 t RH2/year) using a PEM electrolyzer of 5 kW to feed the fuel. Meanwhile, Peru, which had the first large-scale electrolyzer in the region, does not have other projects in operation. Likewise, Mexico and Uruguay do not have any operational renewable hydrogen projects.

Carbon neutrality and new energy market

In recent years, hydrogen has become a crucial element in achieving national carbon neutrality goals and realizing the energy transition by the middle of this century. Its growing prominence is due to its attractive energy properties and its ability to generate sustainable opportunities, replacing coal, natural gas and oil. In turn, the costs of renewable energy and electrolyzers are falling, making renewable hydrogen an economically viable technology in the short term.

In addition to creating a new energy market, hydrogen will reshape the geography of energy trade and consolidate regional energy relations, according to the study on Green Hydrogen Projects in Latin America and the Caribbean. Many countries have announced national hydrogen roadmaps, relevant to setting long-term visions on the role of hydrogen in the energy sector and identifying both technological and policy potential, as well as challenges. Additionally, more than 30 countries have included import or export plans in their strategies, indicating that cross-border trade will continue. While the European Union is likely to become a key import market, Africa, the Americas, the Middle East and Oceania are regions with the technical potential to emerge as major producers and exporters of clean hydrogen.

In this context, most countries in Latin America and the Caribbean have a high renewable potential, according to the report “Green Hydrogen Projects in Latin America and the Caribbean”, the quality and abundance of renewable resources (wind and solar) , combined with available space and access to water, facilitate the deployment of competitive large-scale renewable hydrogen projects. In this way, renewable hydrogen could be produced for local use and surpluses exported. This would be strengthened by the strategic locations of some Latin American and Caribbean countries as trade and transit centers.

However, Latin America and the Caribbean face different regional challenges that must be addressed for the sustainable development of the hydrogen market. Success will depend on crucial policy decisions taken in the coming years, including balancing the interests of energy market players and creating regulatory frameworks aligned with the global and regional context and perspectives.

Advances in hydrogen policy and regulation

Of the eight countries analyzed in the aforementioned report “Green Hydrogen Projects in Latin America and the Caribbean”, five have public hydrogen policies in the form of a strategy, roadmap or national plan. Chile was the first Latin American country to launch a comprehensive strategy in 2020. Key opportunities include replacing fossil fuel-based hydrogen in refineries and finding new hydrogen applications for heavy and long-distance transportation. In addition, the country has set annual production targets of 200 kt of RH2 by 2025 and an increase in national electrolyzer capacity to 5 GW by 2025 and 25 GW by 2030. Currently, the strategy is accompanied by the Action Plan 2023- 2030, which aims to strengthen measures and goals with the participation of communities, civil society organizations, academia and industry.

Colombia followed with the publication of a national hydrogen roadmap in September 2021, which defines a production target of at least 50 kt of blue hydrogen by 2030 and a capacity of 1-3 GW of electrolysis by 2030, without assuming commitments nor establish longer-term renewable hydrogen commitments. For its part, Argentina launched the National Low Emission Hydrogen Strategy 2030, with the aim of creating a roadmap to promote public-private cooperation, investment in science and technology, and industrial participation. However, it has not defined production or capacity objectives.

Regulatory challenges

Countries such as Uruguay and Costa Rica have launched their strategy and roadmap in 2022 and 2023, respectively. Costa Rica announced an installed electrolysis capacity target of 150-500 MW by 2030, while Uruguay plans to reach 1 Mt RH2/year by 2040, increasing electrolysis capacity to 0.1-0.3 GW in 2025, 1- 2 GW in 2030 and 10 GW in 2040. As for Peru and Mexico, neither has published a national policy, although the Hydrogen Associations of Peru and Mexico have proposed a hydrogen roadmap as a guide. It is worth mentioning that Brazil lacks a consolidated strategy despite its numerous project announcements, although it published a resolution, which establishes the National Hydrogen Program and the program’s governance structure.

While governments are essential to support industry investment and create a regulatory framework that can help the development of hydrogen projects, the report laments that Latin America lacks specific regulations for hydrogen, as it is generally considered an element chemical and a hazardous substance rather than a fuel or energy carrier. Furthermore, the existing regulatory framework is insufficient, generic or outdated and does not recognize the renewable energy value chain or its potential uses.

Since 2006, Argentina has had a hydrogen promotion law that regulates hydrogen as a fuel, but it only establishes in general terms that it “promotes the research, development, production and use of hydrogen as a fuel and energy vector. generated through the use of primary energy and regulating the leverage of its use within the energy matrix.” Therefore, it is clear that it does not refer to renewable hydrogen. However, an update is being promoted to adapt the regulation to the production of renewable hydrogen. In addition, a renewable energy bill presented in 2021 aims to promote the research, development and production of renewable hydrogen as an energy alternative, as well as promote the design of a national hydrogen plan that establishes concrete objectives.

Chile develops a general regulation

Meanwhile, in Chile and Colombia, regulations are being developed in their early stages. On the one hand, Chile’s enabling standard is related to the Energy Efficiency Law, which includes hydrogen among the energies under the jurisdiction of the Ministry of Energy, although it is necessary to adapt or create the regulatory framework to comply with the National Strategy.

Currently, the country is developing a general regulation for hydrogen installations for production, conditioning, storage and consumption systems, with safety standards based mainly on NFPA 2. For now, a guide has been published to support applications for authorization of hydrogen projects to encourage their implementation, while environmental evaluation criteria have been published. In addition, regulations are being developed for service stations and the modification of existing regulations for gas installers.

For its part, Colombia has begun to develop regulatory initiatives to recognize the importance of renewable hydrogen to decarbonize the industry. For example, the Energy Transition Law, Law 2,099, recognizes “green” and “blue” hydrogen as “non-conventional renewable energy sources” and “non-conventional energy sources”, respectively. The law also enables the tax benefits of Law 1,715 for both types of hydrogen for 30 years. These include a deduction of up to 50% of income tax, exclusion of goods and services from VAT, exemption from tariffs and accelerated depreciation. In addition, Decree 1,476 promotes innovation, research, production, storage, distribution and use of hydrogen. More recently, CONPES document 4.118 establishes actions to develop the infrastructure required for the export of hydrogen and its derivatives and their use in the maritime sector.

Costa Rica stands out for having national standards that allow the implementation and operation of hydrogen applications. Additionally, Congress is debating a tax incentive bill for renewable hydrogen. In turn, Peru does not have a legal framework, but the Peruvian Hydrogen Alliance has presented a regulatory proposal that is under evaluation. Furthermore, within the 2022 climate emergency decree, renewable hydrogen was introduced, highlighting actions such as designing promotion programs for the technological development, use and production of renewable hydrogen, as well as promoting the introduction of electric vehicles powered by renewable hydrogen.

In the case of Mexico, several regulatory frameworks and energy policies mention hydrogen, but only in terms of production and exploration. In 2021, an update to the Industrial Electricity Law recognized hydrogen as clean energy suitable for combustion or fuel cells. Finally, while Uruguay does not currently have an initiative to regulate hydrogen, this could change in 2024, when progress is expected related to the implementation of sector-specific regulations for technical and safety standards and permitting processes.

Contribution of E&M Combustion regarding hydrogen combustion

E&M Combustión provides advice, design, manufacturing and commissioning of Hydrogen Burners and Hydrogen Combustion Systems in power generation plants and industrial processes, supported by its role as an international benchmark in advanced combustion technologies, and its experience in this area. In 2022, E&M Combustión compiled the main emerging green hydrogen initiatives in Latin America.