News | Industrial Combustion Equipment

All the latest News on our company

Global investments in oil and gas will reach $628 billion in 2022

Posted on: 14 / 10 / 2021 | 0 Comentarios | Tags: Hot Oil Unit, IDBH, IDBH, Investments in oil and gas, Mobile Steam Generation Systems, Oil and Gas, Petróleo y gas, Previsiones inversión petroleo y gas, Sistemas móviles de generación de vapor

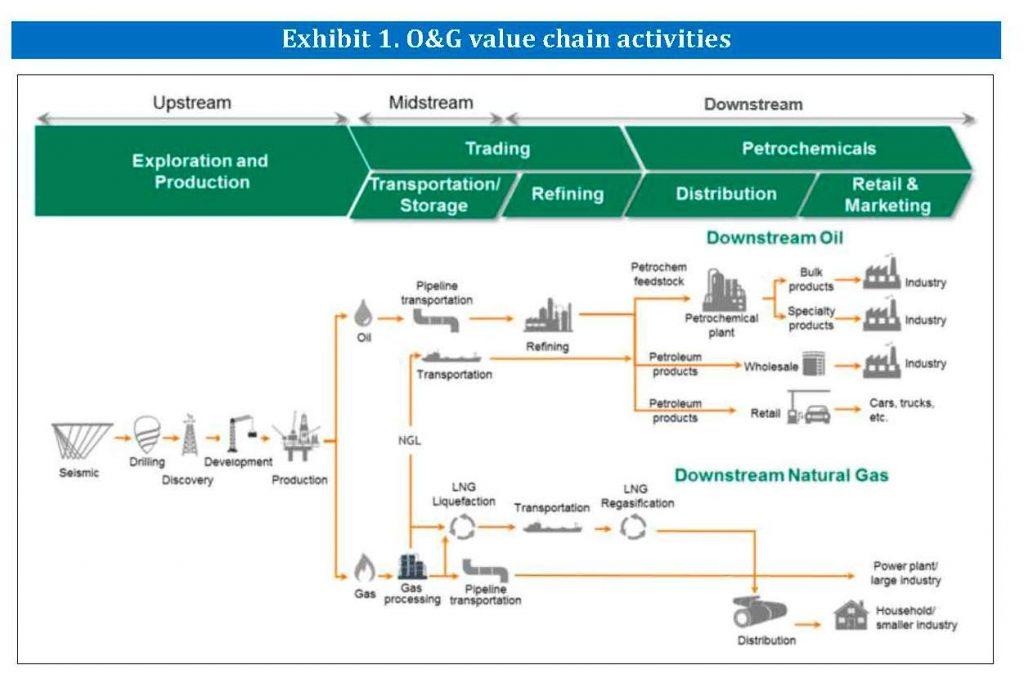

Global investments in oil and gas are set to rise by $26 billion this year, led by gas and LNG exploration and production, as the industry continues its recovery after overcoming the worst of the pandemic and Omicron variant hurdles. A report from Rystad Energy projects that overall oil and gas investments will rise 4% to $628 billion this year from $602 billion in 2021.

The driving factor for this forecast of global oil and gas investments is the 14% increase in upstream gas and LNG investments. These segments will be the ones with the highest growth this year, with a jump from investments of 131,000,000 million in 2021 to around 149,000 million in 2022. Although this figure does not exceed those due to the pandemic, investments in the sector are expected to exceed 2019 levels of $168 billion in just two years, reaching $171 billion in 2024.

Increase in E&P investments

Investments in oil exploration and production are forecast to rise from $287 billion in 2021 to $307 billion this year, up 7%, while mid-stage and production investments will decline 6.7% to $172 billion this year.

According to Rystad Energy forecasts, the widespread spread of the Omicron variant will inevitably lead to movement restrictions in the first quarter of 2022, limiting energy demand and recovery in the main oil-consuming aviation and road transport sectors. . But despite the ongoing disruptions caused by Covid-19, the outlook for the global oil and gas market is promising,” says Audun Martinsen, head of energy services research at the company.

Delving deeper, the Global Oil and Gas Investments report projects that global shale investments will increase 18% in 2022, reaching $102 billion in 2022 compared to $86 billion in 2021. It is expected that offshore investment will increase by 7%, from 145,000 million to 155,000 million, while conventional onshore will grow by 8%, from 261,000 million to 290,000 million.

Australia and the Middle East lead oil & gas investment

Regionally, Australia and the Middle East stand out, with Australia likely to see a 33% increase in investment, thanks to greenfield gas developments. In the Middle East, investments will increase by an anticipated 22% this year, as Saudi Arabia increases its oil export capacity and Qatar expands liquefied natural gas (LNG) production and export capacity.

This year’s investment growth was largely pre-programmed by the $150 billion in new projects approved during 2021, up from $80 billion in 2020. New approvals activity in 2022 is likely to match 2021 levels , with a similar amount of spending on projects in the short and medium term.

In North America, enforcement activity is expected to pick up, with more than $40 billion in projects due to be approved in 2022. Six LNG projects are expected to receive the green light, five in the United States and one in Canada. Offshore projects will also provide ample opportunities for contractors, as TotalEnergies’ North Platte project enters the final stage of its bidding process and LLOG Exploration’s Leon and Chevron’s Ballymore developments in the US Gulf of Mexico. they seek to move into the development phase in 2022. For Africa, however, 2022 is expected to be another quiet year with sanctioned projects expected to be worth a comparatively small $5bn.

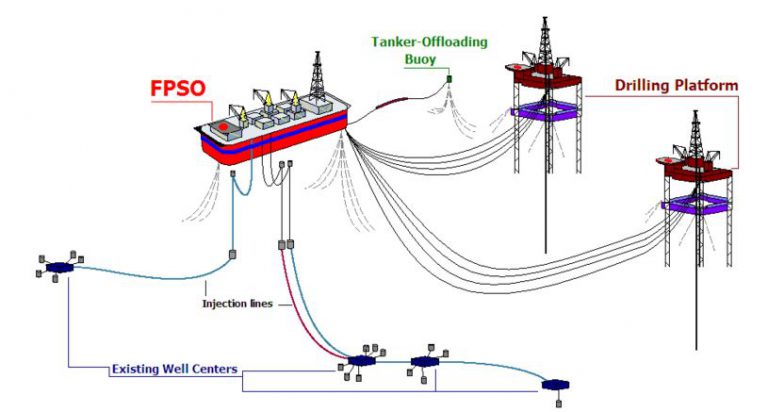

When it comes to offshore field approvals, there are around 80 projects worth a total of $85 billion approved globally by 2022. Of these, 10 are floating production storage and offloading (FPSO) units, 45 involve subsea projects and 35 are grounded platforms. Latin America and Europe will account for around 24% of each approved offshore securities next year, with deepwater expansions expected in Guyana, Brazil and Norway following recent tax changes.

Challenges for oil and gas growth

The number of sanctioned offshore projects is expected to increase year on year, but will remain unchanged in terms of capital commitments. A prominent concern for 2022 is execution challenges related to the pandemic and rising inflationary steel costs and other input factors. This is likely to make traders slightly cautious about significant capital commitments. Additionally, major offshore operators are being challenged in their portfolio strategy as the energy transition unfolds, with many exploration and production companies already directing their investment budgets to low-carbon energy sources.

For offshore contractors, the energy transition could be advantageous for wind energy developments. Spending in the offshore wind sector reached nearly $50 billion last year, double 2019 levels. By 2025, we expect investments in offshore wind to rise to $70 billion as demand for clean energy increases. By contrast, the offshore oil and gas sector will face a challenging energy transition period with oil demand likely to peak in the next five years, limiting offshore investment to around $180 billion. $ in 2025.

E&M Combustion equipment for oil and gas industry

In the area of oil and gas, E&M Combustión contributes to the development of innovative combustion technologies with specific solutions for each industrial process. In addition to being an international benchmark in ATEX burners (EXplosive ATmospheres), the company offers the application of its combustion equipment in Hot Oil Unit (HOU), Indirect Bath Heaters (IDBH), Mobile Steam Generation Systems and Floating Production processes, Storage and Offloading (FPSO) unis.

In this field, the company has designed and manufactured equipment for installation in refineries in Dubai (mobile steam generation systems to improve the oil extraction process), Kuwait, Kazakhstan and India. In the latter country, it has participated in the modernization of 4 refineries, with the supply of 30 industrial burners to operate in indirect water bath heater systems (IDBH).