News | Industrial Combustion Equipment

All the latest News on our company

The Oil and Gas value chain: a focus on oil refining

Posted on: 19 / 12 / 2018 | 0 Comentarios | Tags: ATEX burners, Bath Heaters, Burners for petrochemical, Burners for refineries, Cadena de suministro del petróleo y gas, combustion equipment, E & M Combustion, E&M Combustión, equipos de combustión, gas burners, Heaters, Hot Oil Unit, HOU, Indirect bath heaters, O&G value chain, oil and gas industry, Quemadores para Petróleo y Gas, Quemadores para refinerías

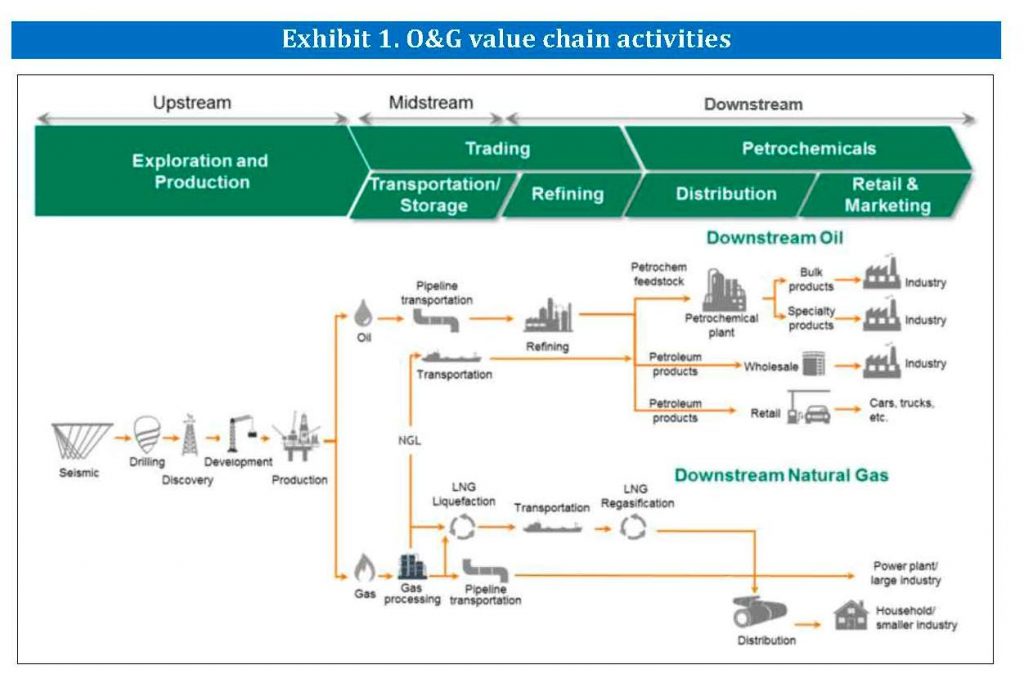

Orkestra Basque Institute of Competitiveness. The Oil and Gas value chain represents the sequence of activities that occur from the supply sources to trading mechanisms, by which oil, oil products, and gas, are sold in the wholesale markets. This process includes upstream (exploration and production), midstream (transportation and storage) and downstream (refining and retail markets).

The representation of the value chain serves as a way of expressing the increase in commercial value that is created as crude is sold, at wholesale prices, from upstream production, transported and stored (midstream), processed or refined downstream, into petroleum products, and eventually sold at retail prices.

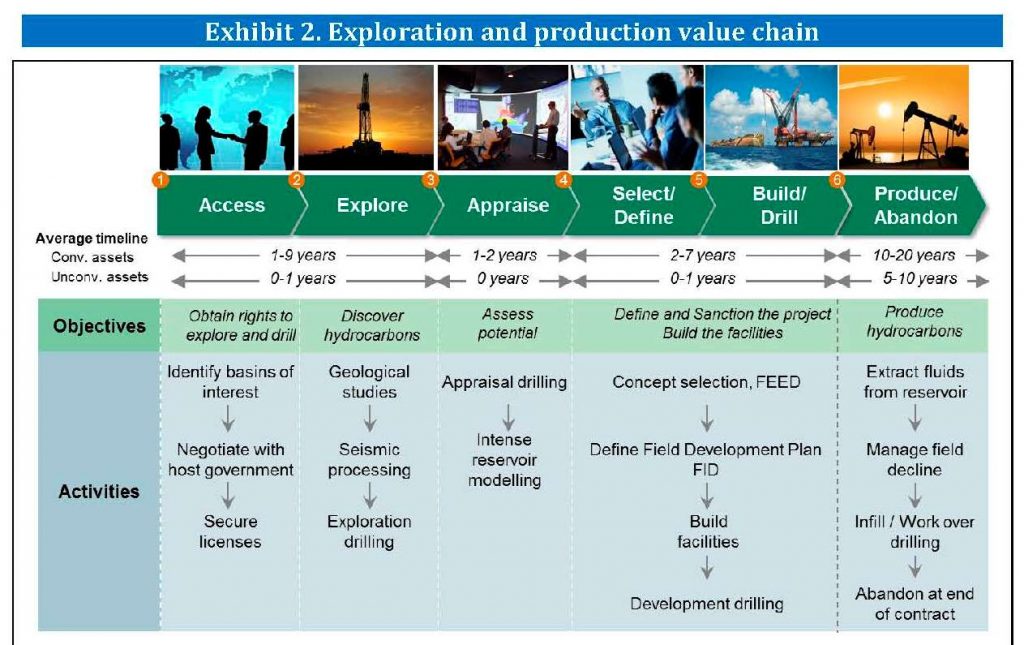

The upstream sector, also known as “exploration and production (E&P)”, includes searching for potential O&G reservoirs, drilling exploratory wells, and developing facilities around those wells that produce commercial quantities of hydrocarbons.This is the most high-risk segment of the O&G industry.

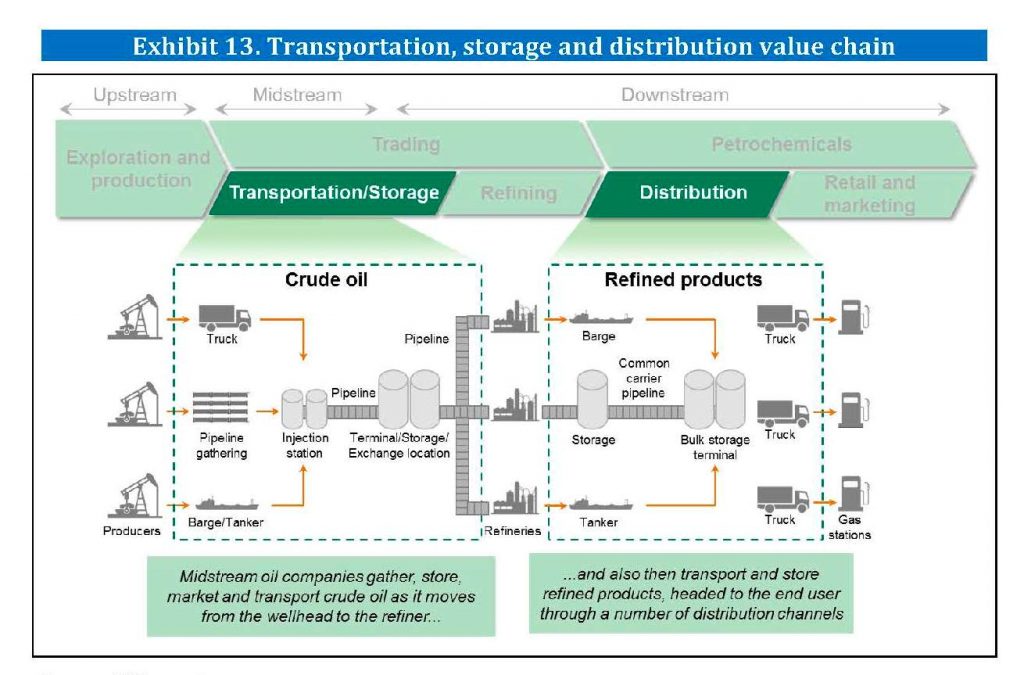

The midstream sector typically involves transporting and storing hydrocarbons, it consists of transport via pipelines, maritime, rail and road transportation, depending on the product.The downstream sector involves crude oil refining to oil products (to final user or petrochemicals feedstock) and its marketing. It also includes the selling and distribution of processed natural gas and the products derived from petroleum crude oil, such as, among others, liquefied petroleum gas, gasoline, jet fuel, diesel oil, other fuel oils, petroleum asphalt and petroleum coke.

The Oil and Gas Exploration and Production

The upstream sector is the phase in the value chain where O&G is discovered, developed and produced, so that it can be sold in the wholesale market. It represents the source of O&G supply and activities of the value chain that are shown. This sector is technologically advanced, and one of the most complex of the up, mid and downstream sectors. It also involves high-risk economic activities, and likewise, the reward potential is generally the largest of all.

Upstream sector profit margins are impacted substantially by outside forces, such as political instability, international conflicts and agreements on supply control by production countries. However, some observers believe that, in the near future, volatility might decrease somewhat, as operators are more flexible today, betting for short-term cycle investments rather than mega-projects, which results in reduced lead times between discovery and the first year of production.

While in the past, lead times might be up to 10 years for big projects, nowadays tight US resources take a year at most, and the most complex existing play extensions take up to three years. This means that an increasing share of supply reacts more quickly to price signals. One additional factor that explains why the unconventional revolution may play an important role in this new dynamic, is that decline rates for these wells are steeper than for conventional fields.

The Refining Process

Refining is the stage of the oil value chain that adds value by converting crude oil, which by itself would have little end-use value, into a range of refined products, such as transportation fuels, suitable for specific end uses. Petroleum refineries are the industrial facilities where this transformation takes place. Refineries are large, capital-intensive manufacturing facilities that operate 24/7, and which spread across large areas. Their processing capacity is typically in the order of hundreds of thousands of barrels of crude oil per day. There are nearly 700 refineries worldwide, with capacity to process around 98.1 million barrels of crude oil per day.

Refining capacity has been growing (within all the different process units), at an uneven rate, following the market demand and competitive landscape. Asia-Pacific and its emerging markets have contributed to a substantial relocation of capacity (to Asia), driven by increasing demand.

When looking at refinery complexity, it is also observed that the ratio between conversion unit capacity and distillation has been growing at a faster pace, due to the existence of new heavier crude oils in the market, which offer lower prices, and therefore, the possibility of capturing higher margins, if prepared with a robust processing complex. The requirements for very complex processing plants often include incredibly high CAPEX, to scale up operations to the point of profitability. In many cases, intuitive new engineering methods are currently not being adapted, because ultimately, the longevity, shutdown time for implementation, scant operational experience, economics and current plant design and equipment do not favor their implementation.

Digitalization processes

Refinery margins have collapsed for several years, mostly due to low demand for products, alongside refinery overcapacity. In the last few years, margins have rebounded, and the sudden decrease in crude oil price was a key contributor to this state of equilibrium, followed by delayed product price movement, while many refiners filled their inventories, provoking an apparent higher demand.

Looking at the regulatory framework, is clear the need for refiners to invest in cleaner processing structures, in order to produce less polluting products. This implies a high investment effort, which affects margins to a higher or lower extent, depending on the preparedness of each player.

Digitalization will continue to penetrate the industry in the future, but the rate at which individual companies can profit will depend on their willingness to invest in, test, and adapt to these new technologies. As digitalization is still relatively new to the industry, in the context of Industry 4.0, many of the technologies are still in their nascent stages, and real-life results are not readily available, which means that ompanies must perform detailed analyses, and develop strategies regarding which technologies to adopt, and how to adapt their operations to maximize their benefits.

E & M Combustion´s Technology offer to the Oil and Gas sector

E & M Combustion is a combustion engineering company focused on the development of innovative combustion technologies that provide specific solutions in industrial processes. The company is a benchmark at the international level in ATEX and NEC industrial burners, Hot gas generators and Combustion equipment for alternative fuels. For the Oil and Gas industry it offers the application of burners in the Hot Oil Unit (HOU) and Indirect Bath Heaters (IDBH) processes that contribute to the development of this sector.

Authors: Eloy Álvarez Pelegry, Manuel Bravo López, Borja Jiménez, Mourão Ana, Robert Schultes

Read more: orkestra_the-oil-gas-value-chain-refining-emcombustion1